Ian Morris

Technical Writer

Updated December 04, 2023

5 min

iText Core and pdfHTML enabling dynamic statement generation for Green Dot Bank

Ian Morris

Technical Writer

Background

Green Dot Corporation is a US financial technology and registered bank holding company based in Austin, Texas. Founded in 1999, Green Dot has served more than 33 million customers through their retail and direct-to-consumer products. These include debit, prepaid, checking, credit and payroll cards, as well as robust money processing services, tax refunds, cash deposits and disbursements.

In addition, they serve many millions more through their Banking as a Service (BaaS) platform, which counts a wide variety of leading brands as partners. Fintech companies and well-known consumer and technology customers use this platform to design and deploy their own bespoke banking and money movement solutions in the US.

At the same time, Green Dot offers comprehensive and accessible digital banking options for both consumers and small businesses, as part of their mission to give all people the power to bank seamlessly, affordably, and with confidence. They designed their flagship digital bank “GO2bank” to simplify banking, enabling customers to quickly access, manage, and move their money.

Green Dot has a long history of innovation in the financial technology sector. As such, they are seen as a fintech pioneer, developing a wide range of market-leading technologies and services. In 2013, they launched the first bank account designed to be accessed from a mobile device.

Goals

In order to serve both their BaaS platform customers and Green Dot’s own GO2bank customers, Green Dot needed to dynamically generate digital statements on-demand as PDF. For ease of use and flexibility, the team responsible for the BaaS platform intended to use HTML templates as a basis for PDF creation. Furthermore, using CSS, templates could be quickly customized with logos and client information when onboarding new customers.

Challenges

The primary challenge was evaluating the available PDF libraries to find one that met their needs. Key requirements were to support PDF creation from HTML/CSS, and to easily integrate within Green Dot’s existing .NET-based environment. Following evaluation, the next step was to create proof of concept implementations and perform benchmarks to gauge the performance and stability of the various solutions.

Solution

Since iText is widely used in the banking and financial sector and a well-known and respected solution for PDF creation and manipulation, it was natural that Green Dot’s team selected it for the evaluation stage. The iText PDF SDK is natively available for Java and .NET (C#) and offers a variety of ways to create PDF documents, with a popular choice being our pdfHTML iText Core add-on. Part of the iText Suite’s range of add-on modules for the iText Core library, pdfHTML enables PDF generation from HTML, or other markup formats such as XHTML and XML. On top of that, support for a wide range of CSS tags enables custom styling to be applied to templates.

After evaluating various .NET PDF libraries, iText quickly proved itself as the best choice. Ravi Vemula, who leads the team responsible for payment processing on the BaaS platform, told us, “In our benchmarks, iText was the clear winner in both its performance and HTML to PDF capabilities.”

As a result, Green Dot connected with our Sales department to discuss their requirements and obtain commercial licenses for iText Core and pdfHTML. iText’s commercial customers are released from the open-source AGPLv3 conditions, allowing them to develop in a secure and closed-source environment. This benefits not just the protection of Green Dot’s intellectual property, but also helps them meet the financial sector’s stringent cybersecurity regulations.

In addition, our commercial licenses offer other advantages. Customers get professional support and maintenance from iText’s expert in-house engineers via the iText Support Portal, where we advise and assist with implementations. You also get free upgrades to our new releases with early access provided to development snapshots.

“In our benchmarks, iText was the clear winner in both its performance and HTML to PDF capabilities.”

Ravi Vemula - VP of Payments Engineering at Green Dot

How it works

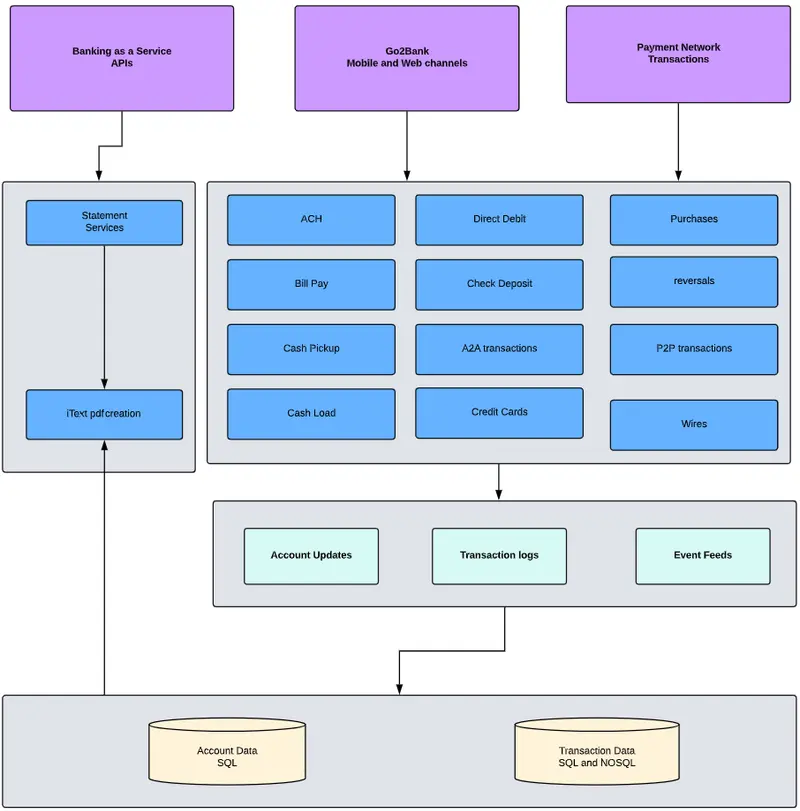

Green Dot’s BaaS platform is a state-of-the art microservices solution. Hosted both on-premises and AWS, they interconnect to provide various applications required by the platform, since it serves their BaaS partners, consumer digital banking, and Green Dot’s branded retail services. Statement requests are combined with account and transaction data and passed to the integrated iText Core and pdfHTML service, as shown below

An architectural overview of Green Dot's BaaS platform

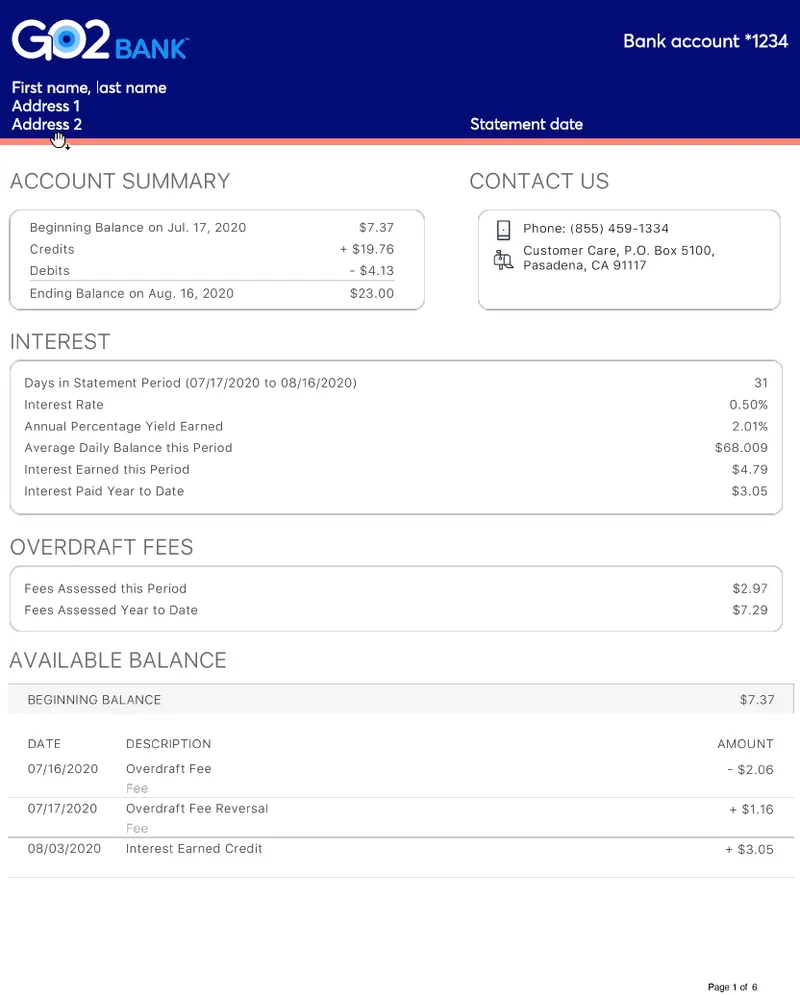

When a request is received, the system checks if there is a statement already generated in storage. If so, it is served to the customer. If there is no pre-existing statement stored on the system however, a request is sent to the iText implementation. The data is requested from the database using the account holder’s number, and iText dynamically populates the desired HTML template with the required data. The PDF statement is then generated on-the-fly and served to the account holder.

Since Green Dot has a wide variety of clients utilizing their BaaS platform, Green Dot’s team customizes templates to meet each client’s requirements. Templates can be quickly adapted to include discrete company logos and other graphics, with custom styling applied painlessly through CSS.

An example on-demand statement by the BaaS platform

"We're very happy with iText's performance. Everything works as expected and rendering HTML templates as a PDF goes very smoothly."

Ravi Vemula, VP of Payments Engineering at Green Dot

In addition, Green Dot also uses templates constructed from PDF form fields, also known as AcroForms. Automatically filling and flattening such templates is a task which is easily handled solely by the integrated iText Core library.

Result

The team began the incorporation of iText into their platform’s architecture in 2019. Ravi told us this was achieved swiftly and smoothly, noting “We had no issues with our development and the integration of iText into our solution.”

In the fast-moving world of digital banking and BaaS, the speed and reliability of services are crucial. Indeed, Green Dot’s team forecasts generating approximately 80 million statements each year. Thus, iText’s reputation for high-volume, server-side PDF generation was a key factor in their decision. As Ravi says, his team’s experience with iText in their solution has been rock-solid: “We’re very happy with iText’s performance. Everything works as expected and rendering HTML templates as PDF goes very smoothly.”

About

Green Dot Corporation (NYSE: GDOT) is a financial technology and registered bank holding company committed to giving all people the power to bank seamlessly, affordably and with confidence. Green Dot's technology platform enables it to build products and features that address the most pressing financial challenges of consumers and businesses, transforming the way they manage and move money and making financial empowerment more accessible for all.

Green Dot offers a broad set of financial products to consumers and businesses including debit, checking, credit, prepaid and payroll cards, as well as robust money processing services, tax refunds, cash deposits and disbursements. Its digital bank GO2bank offers consumers simple and accessible mobile banking designed to help improve financial health over time. The company’s banking platform services (or “BaaS”) business enables a growing list of the world’s largest and most trusted consumer and technology brands to deploy customized, seamless, value-driven money management solutions for their customers.

Founded in 1999, Green Dot has powered more than 33 million accounts directly, and many millions more through its partners. The Green Dot Network of more than 90,000 retail distribution locations nationwide, more than all remaining bank branches in the U.S. combined, enables it to operate primarily as a “branchless bank.” Green Dot Bank is a subsidiary of Green Dot Corporation and member of the FDIC.