Nikki Manthey

Updated July 14, 2025

5 min

Smart Data Extraction in Financial Services: Enhancing Efficiency and Compliance

Nikki Manthey

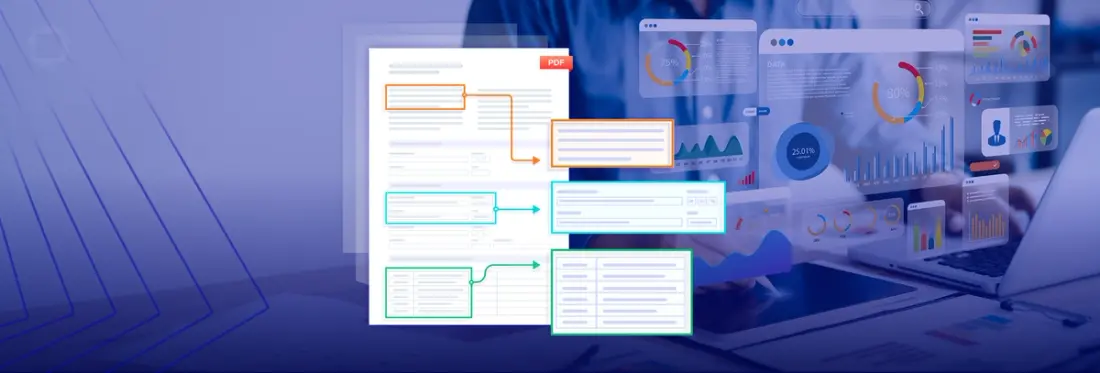

Summary: As the finance sector continues to digitize, valuable insights and data remain locked away in PDFs. Apryse Smart Data Extraction is a data extraction solution that enables teams to quickly unlock info with a high degree of accuracy, stay compliant, and boost operational efficiency.

A completely digital financial world has never been closer than it is in 2024. Words like “fintech,” “decentralized finance” (or DeFi), and “crypto” have entered the common vocabulary and new technology seems to be launching every day. Despite this, legacy systems and documents still exist in the mechanisms of world finance.

For example, more than 43% of international banking systems still rely on COBOL, a programming language from the late 50s. So it can be hard for the industry as a whole to shake off the idea of bankers toting briefcases full of physical papers.

Lingering legacy documents are increasingly being digitized and converted into PDFs or similar formats. Even though digital documents are much easier to share, use, and store, it can still be difficult to quickly unlock the valuable data and insights in those documents.

Apryse Smart Data Extraction can help. Apryse Smart Data Extraction is a data extraction solution that minimizes manual errors, helps maintain compliance, enhances operational efficiency, and enables financial institutions to quickly access information for analysis, reporting, forecasting, and more.

What is Apryse Smart Data Extraction?

To put it simply, Apryse Smart Data Extraction is intelligent data extraction that just works. Part of the Apryse SDK, it uses proprietary AI technology to accurately recognize and extract data, text, tables, and other structural information in PDFs. You can then send the extracted info directly to other databases and workflows for operations, analytics, and more.

Apryse Smart Data Extraction delivers exceptional accuracy right out of the box, with no need for training models or manual verification to check for errors.

Get more details about Apryse solutions for the finance sector.

The Challenges of Manual Document Processes

Imagine you've got a digital document, let’s say a loan application, and you’re tasked with entering customer information from that document into another system for further processing. Just a quick readthrough, a couple of clicks, and a bit of assistance from copy and paste. It couldn’t have taken more than a few minutes at most, right?

Now imagine you have to do that same process thousands of times. And that’s just the start of the manual document processing misadventures.

- Speed: Even for seasoned professionals and typists that can go 100+ words per minute, manual data extraction is slow. And you needed those insights yesterday.

- Errors: Nobody’s perfect, not even machines. But adding people into the mix can result in errors, as Citigroup found out in 2020 when a human-caused mistake cost them nearly $900 million.

- Scale: As we saw in the hypothetical scenario above, it would be impossible for a person to manually extract data from thousands of documents in a single day, let alone a few hours (or even minutes). Smart Data Extraction makes it possible.

- Security: Manual processes and human-caused errors can lead to costly data breaches. A Ponemon report showed that, in 2023, the average annual cost of security incidents caused by an employee (or former employee) rose to $16.2 million.

- Compliance: In addition to legacy document formats, legacy legislation and regulatory standards are also being updated as digitization continues. Modification of manual document process to maintain shifting compliance standards can be difficult.

Learn how Apryse makes financial compliance simpler.

How Apryse Smart Data Extraction Solves Finance Sector Challenges

Precision, Precision

Apryse Smart Data Extraction uses AI to go far beyond text recognition, extracting tables, forms, and other document structures with exceptional accuracy. Plus, advanced form analysis identifies labels and content in non-interactive PDFs and auto-generates interactive elements in static forms. No data is left behind, so you can see and effectively use every piece of info that’s contained in your documents. This streamlines workflows, reduces errors, and boosts efficiency.

Keeping Up with Compliance

The finance industry is heavily regulated, with different countries and jurisdictions each implementing their own regulatory standards. Apryse Smart Data Extraction automates the data extraction process, which reduces the risk of human error and ensures compliance with shifting requirements. Plus, our Smart Data Extraction solution uses advanced encryption and data protection measures to ensure confidential customer info is kept safe.

Fewer Growing Pains

Apryse Smart Data Extraction’s automation, speed, and accuracy takes some of the fear out of the phrase: “Do more with less.” Our solution is easy to implement and quickly scales with your growing financial institution without the need for additional resources. This helps you save time and money while improving services.

Learn about the latest improvements to Apryse Smart Data Extraction. Read our blog post.

Apryse Smart Data Extraction Use Cases in Finance

Here’s a few examples of how Smart Data Extraction can be used to improve processes in the finance sector.

Loan processing: Using Apryse Smart Data Extraction to automate data extraction from loan documents can result in significantly quicker loan processing times and a reduction in credit decision errors. This leads to improved customer satisfaction.

KYC (Know Your Customer) processes: Often the first line of defense against financial fraud, KYC checks are an integral compliance component that verifies the customer's identity and background. Using Apryse Smart Data Extraction to automate parts of KYC workflows boosts efficiency, maintains security, and demonstrates a commitment to customer trust and privacy.

Financial reporting and forecasting: The quality of financial reporting is only as good as the data it’s based on. Apryse Smart Data Extraction ensures information integrity and accuracy, plus enables data to be quickly extracted from document formats that would usually require manual processes to gain insight from. This gives financial institutions a larger data pool to help inform current and future business strategies.

Unlock Insights Faster with Apryse Smart Data Extraction Solutions

Are you ready to quickly unlock the valuable insights and data in your PDFs, improve efficiency, maintain compliance, and take your financial workflows to the next level? Start your 30-day trial of Apryse today. If you have any questions, feel free to get in touch with us anytime, or chat with our engineers about the technical details on Discord.