Nikki Manthey

Updated May 16, 2024

6 min

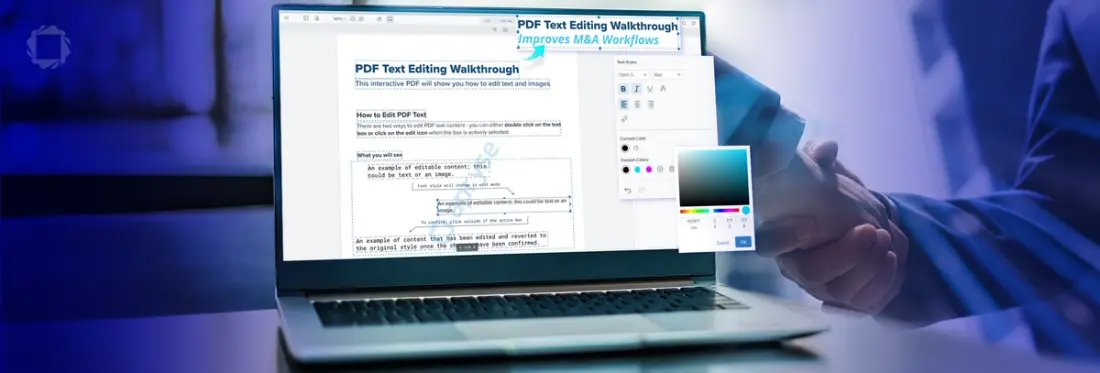

Done Deal: How PDF Text Editing Improves M&A Workflows

Nikki Manthey

Summary: Mergers and acquisitions are complex and time-consuming financial transactions that can involve hundreds of documents. Learn how Apryse PDF editing capabilities enable teams to directly modify working files, making M&A document workflows more efficient, secure, collaborative, and accurate.

In the business world, mergers and acquisitions are, well, big business. In 2023, global M&A deals were valued at US$2.5 trillion, with approximately 55,000 transactions completed. And that’s despite the worst financial crisis since 2008.

Consolidating companies or their assets is typically a lengthy and complex process involving a lot of negotiation, collaboration, financial and legal considerations, security, due diligence, approvals, and paperwork. So when it comes to the digital documents associated with M&A, like PDFs, everything has to be pixel-perfect.

Apryse WebViewer offers intuitive and secure PDF editing capabilities, including PDF text editing, which enables teams working on M&A documents to directly edit working files without the need for third-party solutions, multiple versions, or format conversions.

Read on to see how Apryse helps make merger and acquisition workflows more efficient, secure, collaborative, and accurate.

What is M&A?

Put simply, M&A stands for mergers and acquisitions, which means combining businesses or their major assets via financial transactions. Though the words that make up the term M&A (“mergers” and “acquisitions”) are often used interchangeably, they mean something slightly different.

Here are some common types of M&A deals:

Merger: This type of transaction occurs when two companies of approximately the same size decide to join and move forward as a single business entity. It can also refer to a friendly purchase where both CEOs agree that joining together is a beneficial move. These deals can be structured in many ways.

Acquisition: In a simple acquisition, the acquiring company gets the majority stake in the acquired business. Unfriendly or hostile takeover deals are also classified as acquisitions.

Consolidation: This combines core businesses and gets rid of old corporate structures to create a new company. Stockholders receive common equity shares in the new firm.

Tender offers: One company offers to purchase the outstanding stock of the other business at a price other than the market price.

Acquisition of assets: In this type of deal, one company acquires the assets of another company. Asset purchase is common during bankruptcy proceedings.

Management acquisition: Also known as a management-led buyout, this transaction occurs when a company’s executives purchase a controlling stake in a business and take it private.

Common Documents Used in M&A Deals

Mergers and acquisitions can involve hundreds of documents, depending on the type of deal. Let’s take a look at some common documents for M&A transactions:

- Non-disclosure agreement (NDA)

- Indication of interest or expression of interest (IOI or EOI)

- Letter of intent (LOI)

- Stock or asset purchase agreement (SPA or APA)

- Merger agreement

- Broker-seller agreement

- Exclusivity agreement

- Due diligence documents

- Disclosure schedules

- Third-party consent

- Legal opinions

- Stock certificates

- Bill of sale

- Assignment and assumption agreement

- Escrow agreement

- Transition services agreement

Of course, this list doesn’t reflect every single document that might be needed for a deal. Due diligence documents alone could fill their own blog post! But here you can see the range of financial and legal agreements involved.

Learn more about Apryse document processing solutions for financial services.

Dealing with the Challenges of M&A Document Management

M&A deals are complex and time-consuming. The related documents and workflows can be, too. Here are a few of the potential document roadblocks faced by M&A teams.

Manual Errors

When millions of dollars are on the line, accuracy counts. Document templates can help eliminate some errors, but each M&A deal is unique and usually involves a lot of people. To keep the transaction on track, any manual errors or inconsistencies in wording need to be corrected as quickly as possible.

Privacy and Data Security

M&A transactions typically involve a large volume of sensitive data and privileged information that’s covered by non-disclosure agreements. A leak could not only jeopardize the deal, but also hurt both companies financially.

For example, in 2017 Kraft Heinz “amicably agreed to withdraw” their offer to purchase Unilever for $143 billion just two days after their plans were announced. The transaction was called off due to early deal leaks. Had it been successful, it would have been one of the largest corporate takeovers in history.

Multiple Document Versions

With so many people involved in a deal, keeping everyone on the same page (literally) is crucial. Multiple rounds of stakeholder review and edits can result in a new document version for every cycle. This can quickly get confusing and cause delays if the right people don’t have access to the latest version of an important document.

Document Format Conversions

Traditionally, the way to edit text in a PDF was to convert it to an MS Word document, make any necessary changes, and then re-convert the Word document back to a PDF. This method is time consuming and could negatively affect the layout of the final PDF. Plus, relying on third-party conversion apps increases the risk of a potential data breach.

Discover the latest enhancements to PDF content editing in WebViewer.

How Apryse PDF Text Editing Improves M&A Document Workflows

When working with M&A documents, how can you merge the best of security, usability, efficiency, and collaboration? Enter Apryse WebViewer’s PDF content editing functionality.

WebViewer is a JavaScript-based document SDK (software development kit) that’s embedded in web applications. It enables you to directly and securely edit text (and images) in a PDF without converting to other file formats or losing document formatting.

Let’s explore a few ways WebViewer’s PDF editing features can help improve your M&A workflows.

Ensure top-tier security

In M&A deals, data privacy is non-negotiable. WebViewer enables client-side PDF editing in your web app, which means your documents stay on your devices. There’s no need for external transmissions or third-party dependencies. This keeps your deal data private and ensures compliance with legal agreements and restrictions.

Erase errors instantly

Accuracy is critical in multimillion-dollar transactions. PDF text editing enables you to fix typos, language ambiguity, and other errors quickly and easily. Just open the PDF in the web app and make the changes. All your edits are applied in real-time and will be instantly visible.

Speed up document review

When it comes to getting the deal done, time is of the essence. WebViewer enables you to directly edit PDFs without converting to other word processing formats, which saves both time and resources. PDF editing includes familiar word processing features like undo/redo, text alignment, font selection, and adjustable line spacing, which means everyone on the team can get up to speed on how to use WebViewer quickly.

Maintain document formatting

Automatic text reflowing enables you to make changes to text in a PDF without affecting the document’s formatting. Every piece of content stays where it should, even after editing. This helps ensure there’s no ambiguity or confusion when stakeholders review an edited document.

Enhance collaboration

WebViewer helps make M&A documents a central source of truth by enabling multiple parties to review, provide feedback, and make updates in the same document. This eliminates the need for multiple versions of a document, which can cause confusion and delays if not everyone has access to the latest version. It also reduces the likelihood of overlapping, conflicting changes being merged into the same document.

See Apryse PDF content editing functionality in action.

Kind of a Big Deal: Explore Apryse PDF Text Editing

If you’d like to try out our powerful and intuitive PDF text editing tools yourself, head over to our demo. Or, if you’re ready to make your M&A document workflows more efficient, you can start a 30-day trial now. If you’ve got any questions or would like more information, feel free to get in touch with our team anytime.